Zoom Out for Perspective: Thriving Amidst Market Corrections

When you look at your investment account, does your stomach churn like you’ve eaten a tainted meal?

Market corrections always happen, and they always feel terrible. We’re currently amid a correction with the NASDAQ over 15% off its highs, the S&P tech sector down almost as much, and many individual companies down much further.

Even seasoned investors sometimes get that queasy feeling as they watch their portfolio balances decline. I imagine this is part of the human condition inherited from ancient times of survival in a world with far more significant risks and fewer resources. Fight or flight.

Corrections of ten percent or greater occur regularly, even during years where returns are ultimately positive. And no matter how challenging those corrections may be, markets typically recover within months, surprising many investors.

If you look at the financial news, you’re likely to hear a lot of dire prognoses about the future: high inflation, recession, Fed rate hikes, geopolitical tensions, and more. Investors are trying to digest all of these probabilities, but not all investors are the same. There are different time horizons, differing objectives, and various strategies. For long-term investors, these corrections, as anxiety-inducing as they may be, are bumps in the road, the price of admission for long-term returns.

Growth and technology stocks have been hit especially hard. In the short term, this is not too surprising. Many investors viewed technology as a short-term trade that benefited from pandemic lockdowns and the work-from-home movement. Sure, some companies got a boost that likely won’t last as we emerge from the pandemic. Still, I believe there will be lasting changes to how we live, work, and play, changes that will lead to years of robust profits for well-positioned, innovative companies.

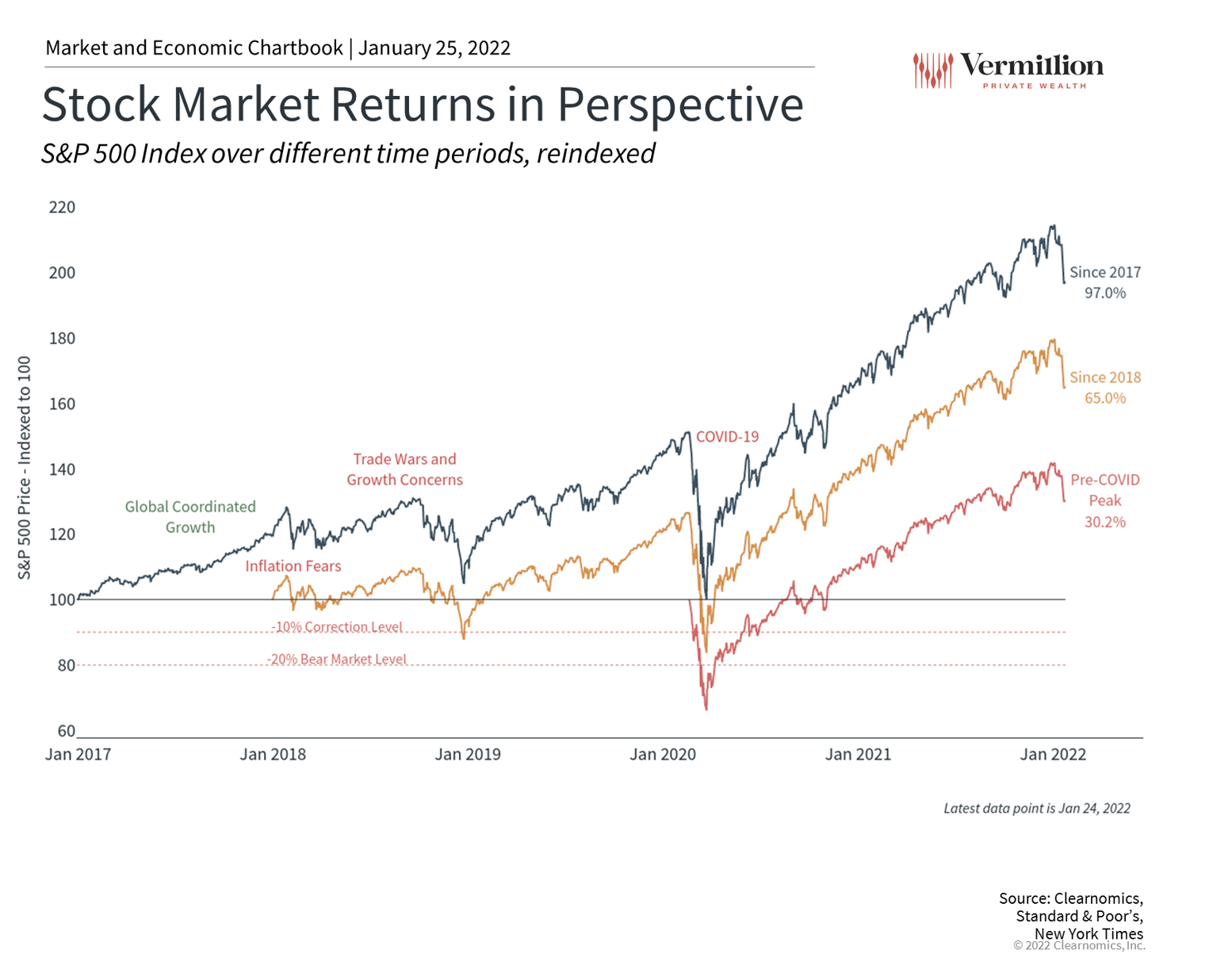

It’s important to consider perspective. Zoom out!

The market may be in or near correction territory, but having a longer perspective might change your view. Even if measured from the highest pre-pandemic levels, stocks are up nearly 30%. When you zoom out further, they’ve faired even better.

Take a look at the FAANG stocks.

While the FAANG stocks are down significantly over several weeks, long-term investors are still doing well.

I hope this has added a bit of perspective. Our human tendencies and cognitive biases make investing difficult, especially during pullbacks and corrections. And while corrections are not fun, they are a normal part of the investing process. No risk, no reward. Historically, investors who can stay focused and disciplined during these periods can improve their odds of financial success.

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from James Vermillion, and all rights are reserved.