Unmasking Weasel Words: Politicians and Financial Experts Use of Transitory

Weasel words sound consequential but only communicate something vague. Politicians are the ultimate weasel word users. They use them to answer simple questions with long-drawn-out answers, using poetic language and passionate displays while saying little meaning or value.

Financial experts are on the heels of politicians in the weasel word use hierarchy. I admit it; I’m guilty too. I sometimes employ them out of sheer laziness to find a better word or clearly define an ambiguous one. I consider myself in rehab for this and appreciate any support.

I felt it’d be appropriate to look at a new favorite weasel word of mine, or least favorite, depending on how you look at it (perspective matters, as you’ll see below).

The recent rise in inflation caused the word “transitory” to appear repeatedly in headlines (again, I’m guilty here). There’s a problem, though. There is no strict definition; thus, anyone making a claim will never be wrong. While it’s not all about being right or wrong, it’s nice to be able to hold pundits to task after they make bold predictions.

Transitory is defined as brief or not persistent. But as any good economist does, I have to ask, compared to what?

Different investors play different games, so words like brief can mean very different things. I’m a long-term investor. My time horizon is decades — 30 to 40 years from now. But there are plenty of traders entering and exiting positions within minutes.

At the helm of a ten-screen battle station, a daytrader, intensely executing their war plan, might define brief as several minutes. A “brief” spike in an asset’s price could be a single print on the ticker tape. To me, that is meaningless, but it’s crucial to traders looking for opportunities to profit from small price changes. So I get a little irked when I hear experts debating whether inflation is transitory or not unless they offer a more precise definition and explain which game they’re playing.

For these same reasons, it’s hard to answer questions from clients or friends about the market or specific companies. For example, the most common question I’m asked is, “what do you think the market will do?” I begin with the truth, “I have no idea,” but I’m not fond of the question because it’s vague. Are you asking about today, this week, this year, the next decade, or my lifetime? What game are you playing?

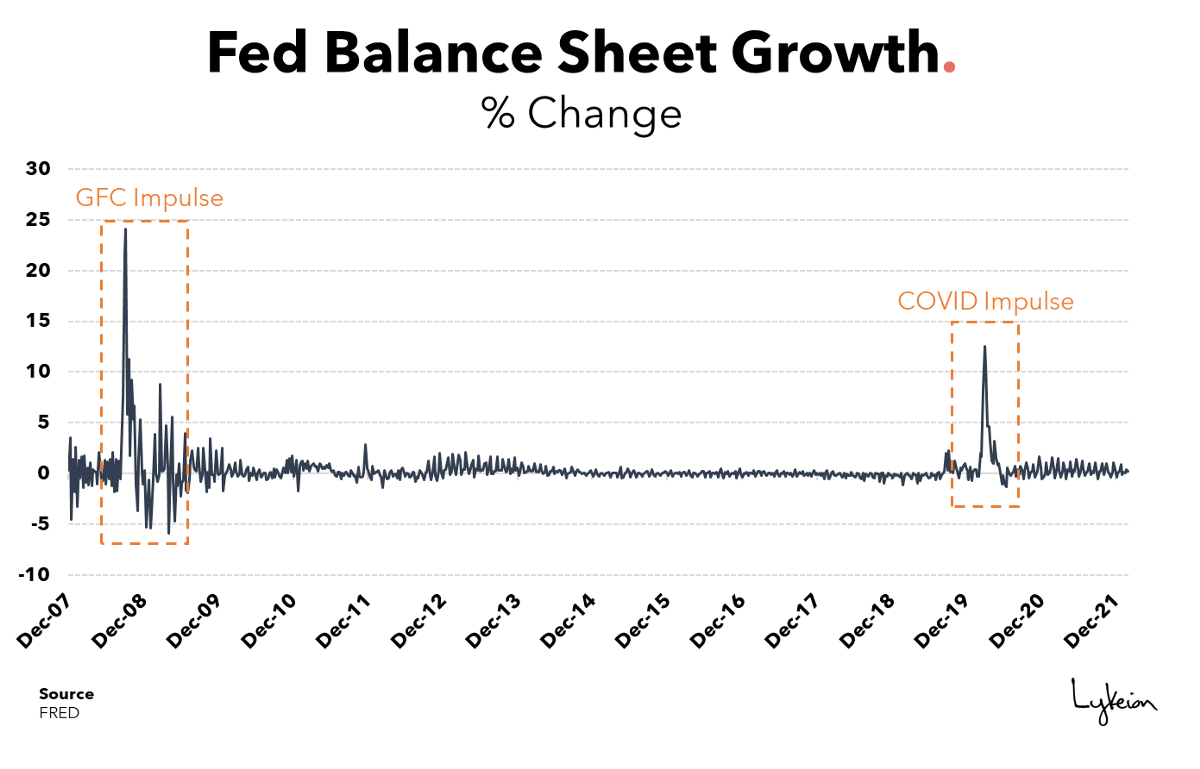

Regarding inflation and whether or not it’s transitory, I start by examining why inflation is heading upward. I’d first point to the monetary response to the pandemic. The federal reserve reacted strongly to prop up the economy, but not nearly as much as during the global financial crisis. Yet, inflation is rearing its ugly head in a more meaningful way this time around. Why?

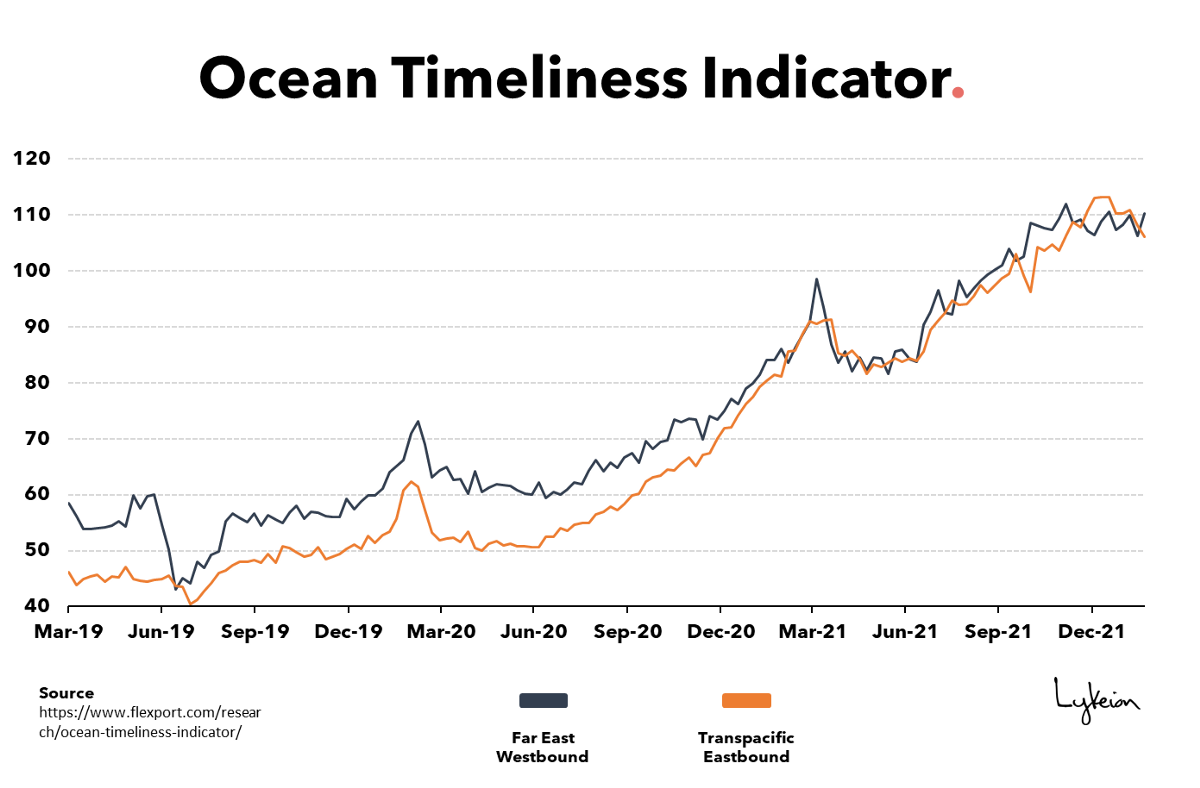

Supply chains. According to Flexport, waiting times for ocean vessels at ports are still up over 200% from pre-pandemic levels. That’s astronomical. It also means that no central bank action (tapering balance sheets, raising rates, etc.) can save the day. Ultimately, prices will remain elevated until goods can get into the hands of consumers. Sorry politicians — we need engineers, innovators, and businesses to solve these problems, not words, resolutions, executive orders, or task forces.

I don’t believe the inflation we’ve seen over the last year will last more than a year or two; thus, I would define it as transitory. But that’s not transitory to the trader interested more in what happens tomorrow than a year from now. Some have already declared inflation isn’t transitory because it’s persisted more than a few quarters — again, it’s all about perspective.

The Russian invasion of Ukraine is further muddying the waters. Prices in commodities like wheat and nickel have shot up drastically — even causing the London Metals Exchange to remain closed for a week. There’s no way to know when or how this conflict ends, so how it impacts prices in the short-mid term is anyone’s guess. But talking heads will speak as if they’ve peered into the future.

Getting worked up over prophetic statements from either side of an issue is usually as valuable as listening to a politician’s weasel-word-filled campaign speech.

Most economic and financial debates aren’t actual disagreements; they’re differing perspectives from people with different time horizons, objectives, and risk tolerances talking over one another. And ultimately, none of them can accurately and repeatedly predict the future. Be wary of weasel words, and before getting too excited about what you’re hearing or reading, determine which game the opiner is playing — otherwise, the signal will be lost in the noise.

Disclaimer: This article is provided for general information and illustration purposes only. Nothing contained in the material constitutes tax advice, a recommendation for purchase or sale of any security, or investment advisory services. I encourage you to consult a financial planner, accountant, and/or legal counsel for advice specific to your situation. Reproduction of this material is prohibited without written permission from James Vermillion, and all rights are reserved.